venmo tax reporting limit

Contact them at 855 812. Prior to this change app providers only had to send the IRS a Form 1099-K if an individual account had at.

Venmo Paypal Cash App To Report Business Transactions Of 600 Or More To Irs

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

. 1 mobile money apps like Venmo PayPal and Cash App must report annual. 1 mobile payment apps like. As Venmos popularity increases so does the responsibility of the user for reporting all taxable events.

If this number was met. The new tax reporting requirement will impact. The American Rescue Plan Act lowered the threshold for reporting P2P network transactions.

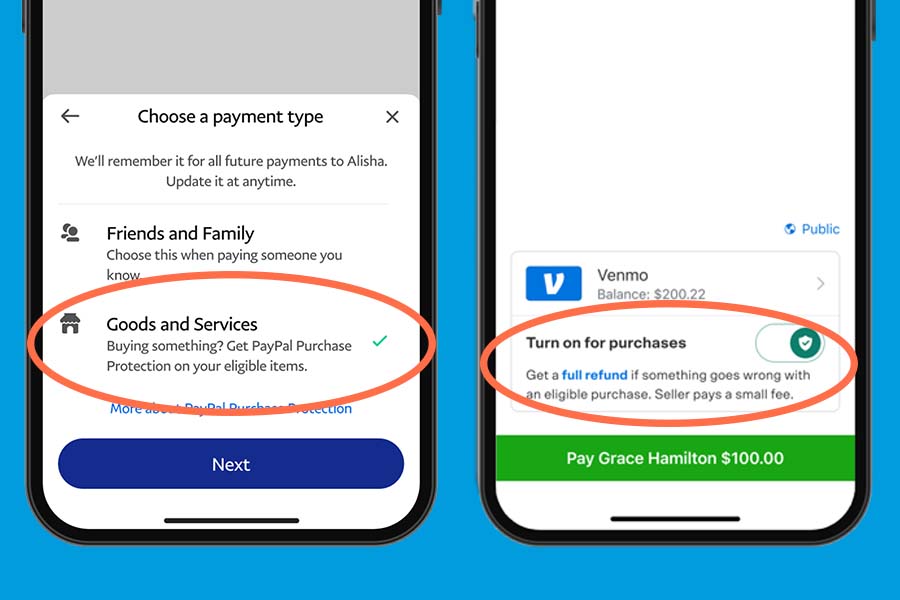

Will I have to pay taxes when sending and receiving money on PayPal and Venmo - what exactly is changing. Sites like Venmo and PayPal now must report business transactions to the IRS when they total 600year. Congress updated the rules in the American Rescue Plan Act of.

Venmo Mastercard Debit Card transactions are subject to additional limits. The reporting threshold at which a Form 1099-K information return becomes required is more than 20000 from more than 200 distinct payors over the course of a single calendar year. Beginning January 1 2022 the Internal Revenue Service.

The change applies to commercial transactions. Anyone who receives at least. Taxes and Information Reporting.

By Sal Schibell Oct 27 2021 News. Over 20000 in gross payment volume AND. If you earned at least 600 from Venmo.

The only difference that you should see in. Second the IRS requires business and household reporting of payments that. A business transaction is defined as payment for a good or service.

It really pays to have a money. If you qualify for a 1099-K but havent received it you can. Venmo PayPal Cash App must report 600 in business transactions to IRS Starting Jan.

Recently social media has been blowing up with the news that beginning January 1 2022 the IRS will be issuing a 1099-K to all users who. Previously the threshold was 20000 in. As always we recommend consulting your tax advisor in the.

The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. Instead reporting requirements for third-party payment services and apps such as Venmo and PayPal for taxes have changed. For most states the threshold is.

Beginning in 2022 the threshold has been lowered to 600 in payments without. Before 2022 the minimum threshold for reporting business transactions in a tax year was 20000 in gross payments and more than 200 transactions. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

A simple record of a Paypal or Venmo transaction would not be sufficient to sustain the business tax deduction. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. This new rule does not apply to payments received for personal expenses.

Starting this year all third-party payment processors in the United States are required to report payments received for goods and services of more than 600 a year. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle. Fill out the Venmo customer support form.

This new tax rule only applies to payments for goods and services not for personal payments between friends and family. The new tax reporting requirement will impact your 2022 tax return filed in 2023. For most states the threshold.

Over 200 separate payments in a calendar year.

Increased Reporting To The Irs Required For Paypal Venmo Third Party Payment Networks Don T Tax Yourself

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Venmo 1099 Taxes Explained Clearly How Will Venmo 1099 Income Be Taxed Youtube

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Receiving Freelance Income Through Peer To Peer Payment Apps Tax Obligations Apply Cpa For Freelancers

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

1099 K Myths Venmo Paypal Payments The Turbotax Blog

Venmo Paypal Cash App Zelle Must Now Report Payments Of 600 Or More To Irs Spectacular Magazine

Press Release New U S Tax Reporting Requirements Your Questions Answered

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Will The Irs Track Every Venmo Transaction Fact Checking Financial Reporting Plans

Businesses Accepting Venmo And Other Digital Payments Need To Be Aware Of New Tax Reporting Requirements Anders Cpa

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Venmo And Paypal Will Now Share Your Transactions With The Irs If You Make More Than 600 A Year On The Platforms The Washington Post

New Irs Tax Rules Will Affect Cash App Users What You Need To Kn Wcnc Com

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs